Tax brackets 2020 calculator

2020 Marginal Tax Rates Calculator. Your tax bracket depends on your taxable income and your.

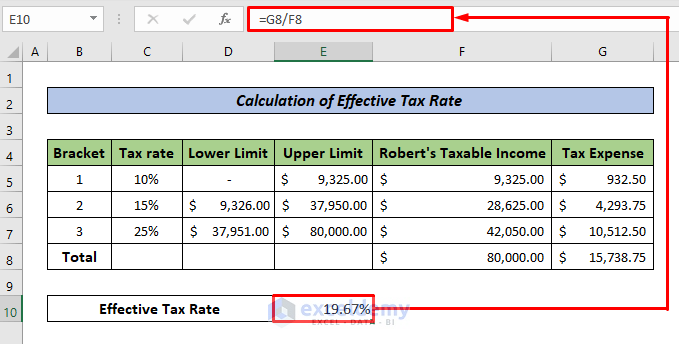

Effective Tax Rate Formula Calculator Excel Template

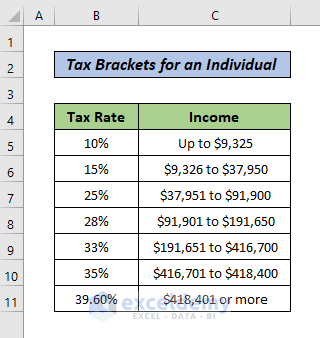

2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

. The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. 2020 Deductions and Exemptions Single Married Filing Jointly. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396.

It can be used for the 201314 to 202122 income years. Use your income filing status deductions credits to accurately estimate the taxes. Find Everything You Need To Quickly Finish Your Past Years Taxes.

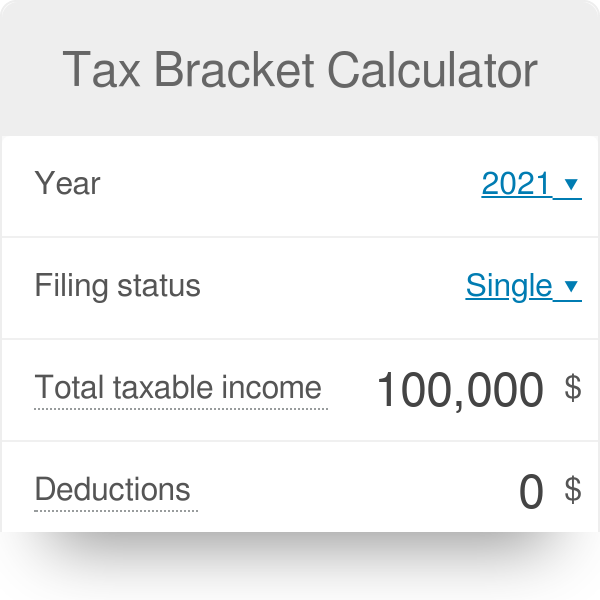

In other words your income determines the bracket you will be. 2021 tax brackets irs calculatorthe new 2018 tax brackets are 10. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Effective tax rate 172. Based on your projected tax withholding for. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

For turbotax live full service your tax expert will amend your 2021 tax return for you through 11302022. Estimate your tax refund with HR Blocks free income tax calculator. 0 would also be your average tax rate.

29467 plus 37 cents for each 1 over 120000. There are seven tax brackets for most ordinary income for the 2020 tax year. Your tax bracket is.

Use our US Tax Brackets Calculator in order to discover both your tax liability and your tax rates for the current tax season. 10 12 22 24 32 35 and 37. A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income.

Bentle K Berlin J and. Ad Complete Past Years Taxes And Get Your Maximum Refund Guaranteed. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

19 cents for each 1 over 18200. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. The new 2018 tax brackets are 10 12 22 24 32 35 and 37. Tax Bracket Calculator Filing Status Annual Taxable Income 2021-2022 Tax Brackets and Federal Income Tax Rates Tax Rate Single filers Married filingjointly or qualifying widow er.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. The AI-powered tax engine finds every possible tax deduction to. As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on.

Your Federal taxes are estimated at 0. Your income is taxed at a fixed rate for all income within certain brackets. Ad Discover Helpful Information And Resources On Taxes From AARP.

This is 0 of your total income of 0. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. 5092 plus 325 cents for each 1 over 45000.

Income Tax Formula Excel University

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Rate Calculator Flash Sales 57 Off Www Ingeniovirtual Com

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Federal Tax Rate In Excel With Easy Steps

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Federal Income Tax

How To Calculate Federal Tax Rate In Excel With Easy Steps

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Tax Bracket Calculator

Paycheck Calculator Take Home Pay Calculator

Inkwiry Federal Income Tax Brackets